Whether you’re about to start your first job, planning a side hustle or diving into the world of investing, there’s one truth you must remember, financial success is not about luck it’s about discipline, consistency, and intelligent habits.

The financial world keeps evolving. New digital currencies appear, technology transforms banking and global markets shift faster than ever. Yet, the founding principles of wealth-building remain constant across generations. Those who achieve lasting prosperity follow certain habits that strengthen both their personal and professional lives.

If you want to take control of your money and build long-term wealth, start practicing these five smart financial habits. When applied consistently, they can transform your financial future.

1. Pay Yourself First — Make Savings Non-Negotiable

The first rule of financial success is simple, always pay yourself before you pay anyone else.

Instead of saving whatever is left after bills and entertainment, flip the script. Treat savings as your most important bill one that must always be paid. This principle, highlighted in George Clason’s classic “The Richest Man in Babylon”, is a cornerstone of wealth creation.

How to Put It Into Action

- Automate savings: Direct 10–20% of your income into a separate high-yield savings account, retirement fund, 401(k), or IRA.

- Keep it untouchable: Don’t dip into this money for daily expenses. Let it grow quietly.

- Build discipline: By automating, you won’t “feel” the loss, but you’ll steadily accumulate wealth.

Remember, financial freedom begins with the habit of saving before spending.

2. Track Every Dollar — Know Where Your Money Goes

The difference between financial stability and financial stress often comes down to one thing: awareness.

You can’t control what you don’t track. Financially successful people know exactly where their money goes because they monitor spending, identify leaks and adjust accordingly.

Practical Tips for Tracking

- Use budgeting tools like You Need a Budget (YNAB) or Mint.

- Categorize expenses into essentials, discretionary, savings and investments.

- Review weekly to spot unnecessary expenses and patterns.

When you start tracking, you’ll notice how much is wasted on small, unplanned purchases. Over time, this clarity helps you cut waste, optimize spending and redirect money toward growth.

3. Avoid Bad Debt — Use Good Debt Wisely

Not all debt is created equal. While some debts are destructive, others can be leveraged to grow your wealth. The key is knowing the difference.

Good Debt

- Education that improves earning potential.

- Real estate that appreciates in value.

- Business loans that generate long-term income.

Bad Debt

- Credit card balances with high interest.

- Personal loans used for depreciating items like electronics or luxury goods.

Golden Rule

- If you’re paying interest on something that doesn’t grow in value or generate income, rethink the purchase.

- Using debt wisely can help you build assets, while careless borrowing can trap you in a cycle of financial stress.

4. Invest Early — Let Time Work for You

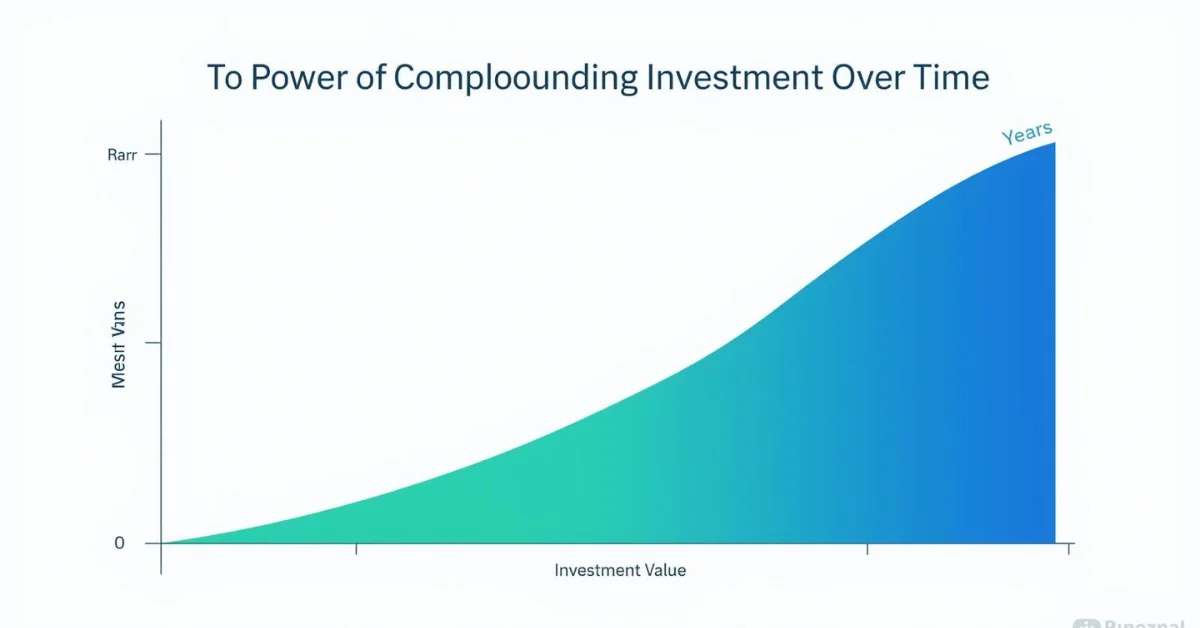

In investing, time matters more than timing. Waiting for the perfect moment to invest often leads to missed opportunities. The longer your money stays invested, the greater the impact of compound growth.

Warren Buffett didn’t build his empire by predicting the market. Instead, he stayed invested for decades, allowing compounding to do the heavy lifting.

Actionable Investment Habits

- Start small with low-cost index funds such as S&P 500 ETFs.

- Use dollar-cost averaging to reduce the impact of market volatility.

- Focus on long-term gains, not quick profits.

As Buffett famously said, “If you don’t find a way to make money while you sleep, you will work until you die.” Start investing now and let your money work for you.

5. Build Multiple Streams of Income — Don’t Rely on Just One

Depending on a single income stream is risky. Job markets shift, industries change and economies fluctuate. That’s why diversifying your income is just as important as diversifying your investments.

Ways to Create Additional Income

- Stock dividends and index funds.

- Rental properties or Airbnb hosting.

- Freelancing or consulting based on your skills.

- Affiliate marketing, blogging or digital products.

- Content creation and monetization.

Robert Allen, author and wealth strategist, once said: “You must have more than one stream of income if you want real financial freedom.” By creating multiple streams, you gain both stability and scalability financial resilience against uncertainty.

Conclusion

Today’s financial landscape is fast-moving, shaped by digital currencies, global markets and technology. But the principles of financial success remain timeless: save consistently, track your money, use debt wisely, invest early and diversify income. Building wealth is not about luck or genius; it’s about discipline, self-awareness and consistent action.

Start small, but start today. Let every coin you save be a seed planted for tomorrow. Spend with purpose, invest with strategy and watch your financial future flourish. Your financial journey won’t change overnight, but with consistent habits, your money will begin working for you creating freedom, security and opportunities for years to come.

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.