The Macroeconomics of Style: Analyzing the Fashion and Lifestyle Ecosystem

A Financial Perspective on Cultural Capital and Global Markets

Author: Arshad Shamsi

Date: January 2026

Introduction: Beyond the Aesthetic

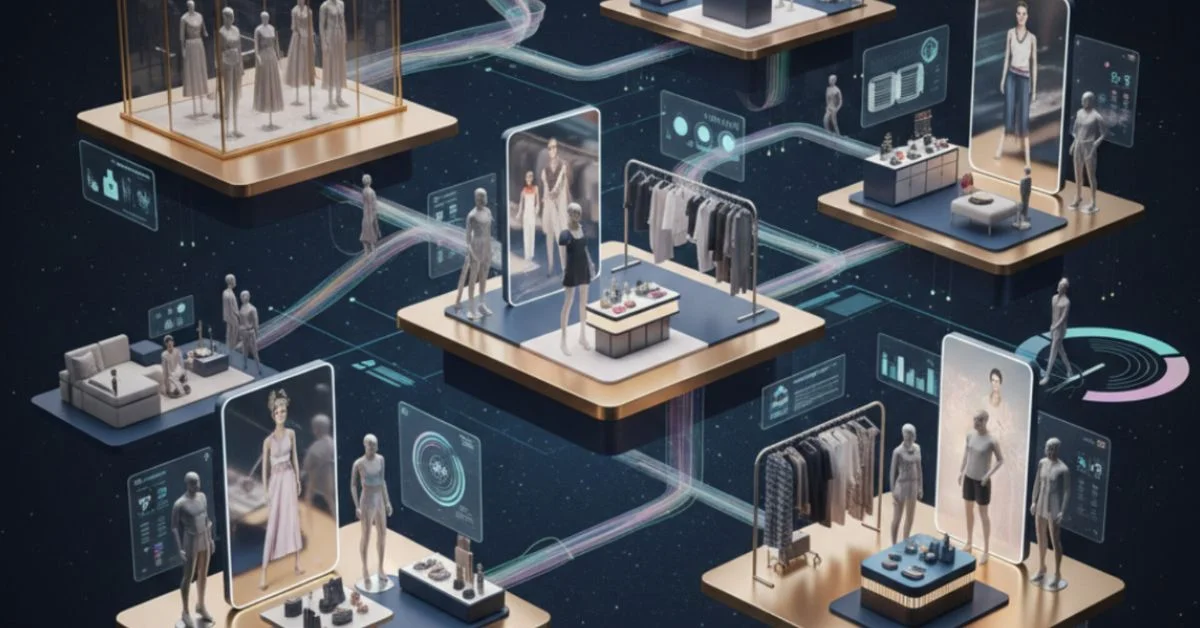

Within traditional global finance curricula, fashion and lifestyle studies are often categorized as “soft” industries. However, a deeper structural analysis reveals that these sectors collectively form a multi-trillion-dollar economic engine, influencing global commodity flows, labor markets, digital innovation, and capital allocation.

In the modern economy, fashion increasingly functions as a leading indicator of consumer sentiment, inflationary pressure, and supply-chain resilience. For both finance students and professionals, understanding this arena is no longer optional. The interaction between cultural trends and capital markets has become a core component of contemporary financial literacy.

Stoctok Educational Policy: This article is for educational purposes only. It does not offer financial advice, investment recommendations, or commercial guidance. It is intended solely for market literacy and historical understanding.

1. Fashion as a Macroeconomic Driver

The fashion industry operates as a complex and globally integrated economic ecosystem. As one of the world’s largest employers and a central pillar of the Consumer Discretionary sector, its influence extends well beyond retail:

-

Commodity Markets: Demand for cotton, silk, and petroleum-based synthetics directly affects agricultural outputs and energy pricing benchmarks.

-

Global Logistics: Fast-fashion models have reshaped international shipping routes, warehousing strategies, and just-in-time inventory systems.

-

Currency Fluctuations: As manufacturing migrates from Southeast Asia toward emerging production hubs in Africa, shifts in capital flows and exchange-rate sensitivities become critical analytical variables. These transitions are structural in nature and are expected to produce long-term effects across the global economy.

2. Behavioral Economics and Brand Equity

Fashion represents a foundational case study in Behavioral Finance. Unlike utilitarian goods, many luxury products function as Veblen Goods, where demand increases as prices rise due to the social status they convey within specific consumer segments.

2.1 Understanding “Goodwill” on the Balance Sheet

Brand loyalty constitutes a powerful intangible asset. When examining the balance sheets of luxury groups such as LVMH, Armani, or Burberry, a substantial portion of enterprise value is classified as Goodwill.

-

Reputation Premium: This reflects the additional value generated through decades of consumer trust and brand recognition.

-

The Competitive Moat: Brand prestige creates a barrier to entry, making it difficult for new competitors to capture market share, regardless of price or product quality.

2.2 Identity-Driven Spending

In the luxury segment, consumers are not merely purchasing goods; they are acquiring identity and affiliation. This emotional and social attachment creates high switching costs, contributing to sector resilience during economic downturns. Status-defining purchases are often among the last expenses reduced in periods of financial stress.

3. The ESG Pivot: Sustainability as Infrastructure

The integration of Environmental, Social, and Governance (ESG) frameworks has shifted fashion from a largely voluntary compliance environment to a regulated financial structure:

-

Regulatory Compliance: European initiatives such as the Strategy for Sustainable and Circular Textiles now mandate lifecycle traceability across supply chains.

-

Risk Management: Investors increasingly view opaque or poorly documented supply chains as material financial risks.

-

Innovation Capital: Capital is being allocated to Fashion Technology, including bio-materials, circular manufacturing, and blockchain-based traceability systems. These innovations provide consumers with transparent “digital passports” detailing the origin and lifecycle of products.

4. The Circular Economy and Resale Arbitrage

What was once considered a niche activity has evolved into a sophisticated secondary market ecosystem. Digital resale platforms now operate at scale, reshaping asset valuation dynamics:

-

Asset Longevity: High-end fashion goods are increasingly treated as stores of value, comparable to fine art or collectibles.

-

Resale Liquidity: Data-driven pricing engines provide liquidity for pre-owned assets, functioning in ways similar to financial trading platforms.

5. Economic Indicators: The “Lipstick Effect”

The beauty and personal care sector often serves as a barometer of consumer confidence. The Lipstick Effect suggests that during economic downturns, consumers may reduce spending on large luxury items while continuing to purchase smaller premium goods, such as cosmetics. This pattern provides early insight into shifts in broader economic sentiment and consumer psychology.

Conclusion: Why This Arena Matters to Finance

The fashion and lifestyle ecosystem serves as a real-world laboratory for analyzing disruption, consumer behavior, and capital movement. It demonstrates how traditional industries are transformed through technology, how cultural identity shapes brand valuation, and how regulation can restructure global supply chains.

For modern finance students and professionals, this sector offers a deep understanding of market psychology and the evolving mechanics of global capital allocation. The pace of change within this arena is not merely incremental; it is accelerating rapidly.

As designers increasingly expand beyond apparel into high-margin sectors such as luxury timepieces and accessories, lifestyle brands are transforming into integrated luxury ecosystems. These shifts are redefining value creation and contributing to new trajectories within the global financial system.