A Deep Dive into Market Trends & Future Opportunities

Artificial Intelligence (AI) is no longer a vision of the future—AI

now is the defining force of the present. What began, just a few

years ago, as a brand-new niche in computer science has

evolved into a multi-trillion-dollar disruptor, transforming sectors

from healthcare and finance to manufacturing, logistics, and

creative industries. The AI revolution is not only reshaping how

the world works but also how capital flows across global markets.

In recent quarters, AI-related stocks have experienced

unprecedented growth, propelled by breakthroughs in generative

AI, large-scale enterprise adoption, and strategic investments

from both governments and global tech giants. Retail investors,

institutional funds, and venture capitalists alike are pouring into

the AI space, betting on its transformational power and long-term

returns.

Let’s dive deeper into:

Why AI stocks are booming

The most influential players and high-potential startups

Future growth projections backed by real data

The risks and strategic approaches for intelligent investing

- Why AI Stocks Are Exploding:

The Power Behind the Surge

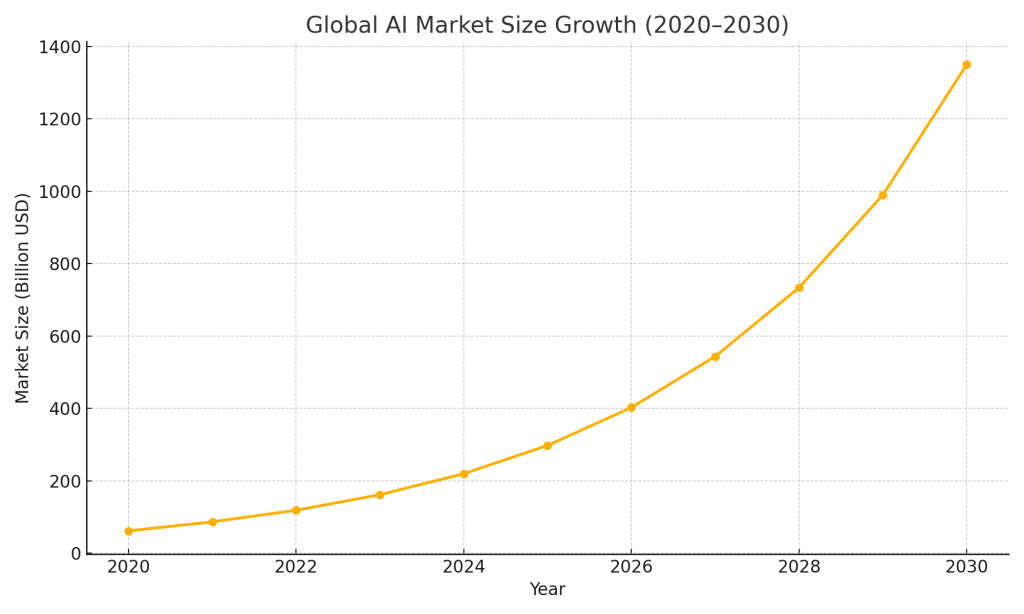

The global AI market is projected to grow at a compound annual

growth rate (CAGR) of 37.3%, reaching an estimated $1.8 trillion

by 2030, according to PwC and Grand View Research. This

explosive growth is fueled by a confluence of technological

maturity, increasing computational power, and strategic adoption

at both public and private levels.

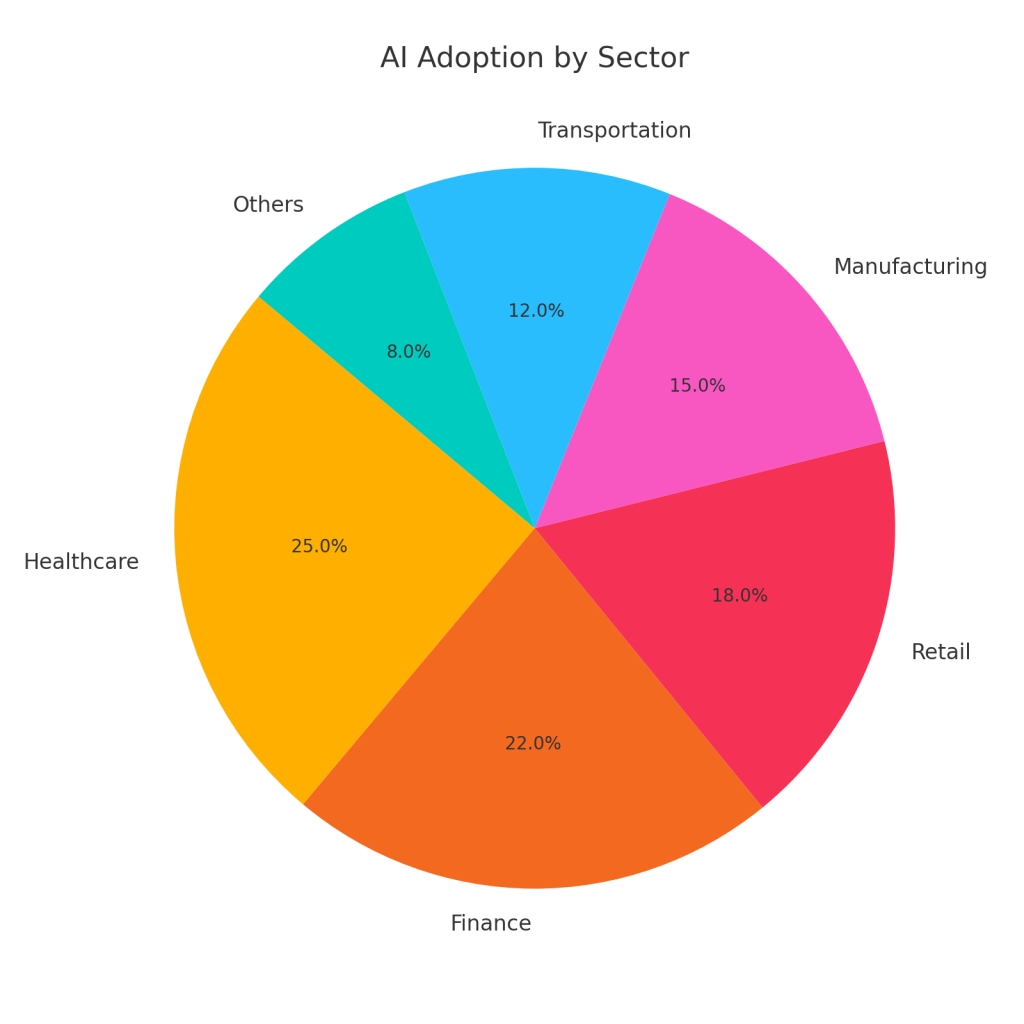

�� Corporate Integration at Scale

Enterprises across industries are embedding AI into their

operations—from automated customer service agents to

predictive analytics, fraud detection, and supply chain

optimization. This operational transformation is significantly

boosting the valuation of AI-enabling companies such as

ServiceNow, Salesforce, and Palantir.

�� The Generative AI Revolution

The advent of large language models (LLMs) like ChatGPT,

Claude, and Gemini has catalyzed the next era of human-

machine interaction. This boom has directly impacted the stock

valuations of companies like NVIDIA, which provides the essential

GPU infrastructure, and Microsoft, whose strategic stake in Open

AI is reshaping its AI-driven service offerings across Azure and

Office 365.

�� Government & Defense Adoption

From AI-powered surveillance to smart city planning and

autonomous warfare systems, governments are now major

players in the AI arms race. The U.S. Department of Defense,

European Commission, and several Asian governments have

allocated billions in AI R&D and procurement, creating

opportunities for firms in cybersecurity, robotics, and AI-integrated

defense systems.

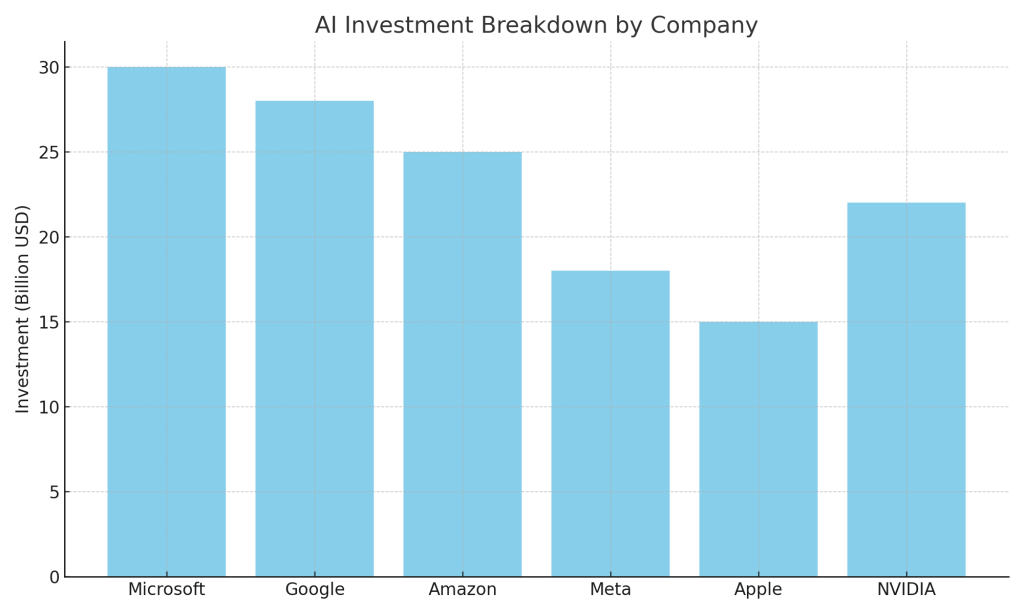

�� The AI Titans:

Big Tech’s Billion-Dollar Bet

The five major tech players—Google (Gemini/DeepMind), Meta

(Llama), Amazon (Bedrock), Microsoft (Open AI), and Apple

(Siri 2.0)—are locked in a high-stakes race to dominate AI

infrastructure and consumer integration. Their massive capital

injections, AI acquisitions, and proprietary model development are

setting the pace of innovation and defining the market’s direction.

- Key Players & Emerging Startups in the AI Ecosystem

While big tech giants dominate headlines, the AI investment

landscape is also filled with dynamic startups and niche players

driving specialized innovation. Understanding this mix is key to

identifying long-term winners.

�� Established Market Leaders:

NVIDIA (NVDA): The undisputed backbone of AI

computation. Its GPUs power nearly every major AI model,

from Open AI’s ChatGPT to Google’s Gemini. NVIDIA’s

valuation has skyrocketed, turning it into one of the top five

companies globally by market cap.

Microsoft (MSFT): A strategic investor in Open AI, Microsoft

is embedding AI across its cloud services (Azure), software

products (Office, Teams), and search (Bing). It’s becoming

an AI utility provider for the enterprise world.

Alphabet (GOOGL): Google’s DeepMind and its Gemini AI

models are positioned to compete directly with Open AI. It

also provides AI capabilities across YouTube, Google Ads,

and Android.

Amazon (AMZN): Through Bedrock and AWS, Amazon is

focusing on generative AI APIs and services, enabling

startups and corporations to deploy LLMs on its

infrastructure.

�� Rising Stars & Disruptive Startups:

Anthropic (Claude): A safety-focused generative AI

company gaining momentum in enterprise adoption.

Scale AI: A leading provider of labeled data for AI model

training, backed by top VCs.

C3.ai (AI): Specializes in enterprise AI platforms across

defense, energy, and healthcare.

Hugging Face: Open-source champion in AI development,

providing tools and models democratized for developers

worldwide.

Sound Hound AI: Gaining traction in voice recognition and

conversational AI across automotive and service industries.

These players represent the diversity in the AI field—from

infrastructure and cloud services to edge deployment and creative

tools.

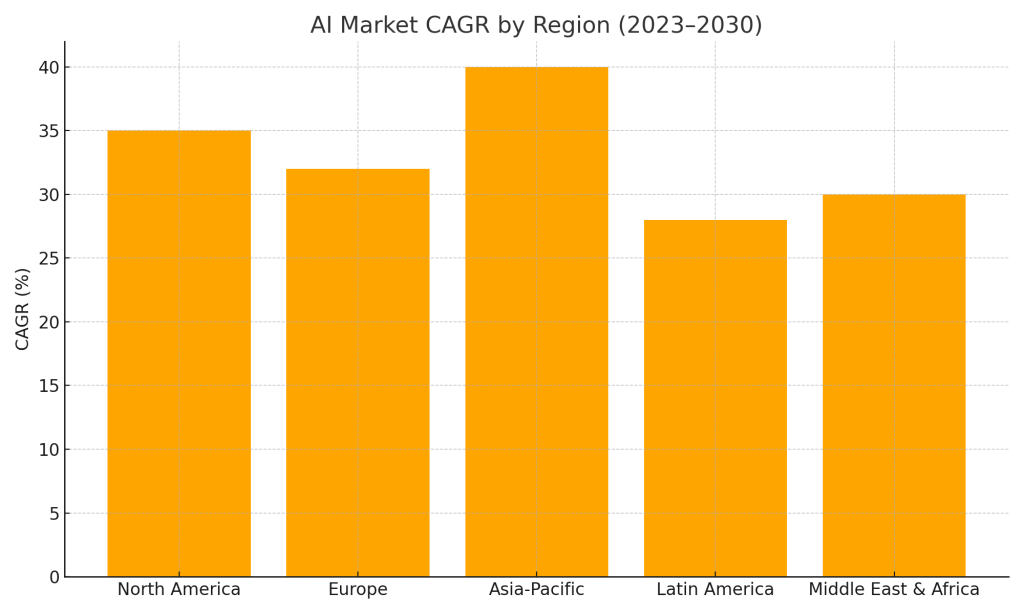

- Future Growth Projections: What the Next 5–10 Years Hold

The next decade promises not just scale, but ubiquity for AI.

Based on market intelligence from McKinsey, PwC, and Statista,

here are some concrete projections:

Global AI Market: Estimated to reach $1.8 trillion by 2030,

growing at a CAGR of 37–40%.

Enterprise AI Spending: Set to surpass $200 billion

annually by 2026, led by sectors like finance, healthcare,

and logistics.

AI in Productivity Tools: Over 75% of enterprise software

will integrate native AI features by 2028.

Global Penetration: Emerging economies in Asia, Africa,

and Latin America will drive the next wave of AI

adoption—particularly in fintech, Agri-tech, and education.

The exponential growth is not just in tech, but in cross-industry

adoption, with AI playing an indispensable role in energy

efficiency, autonomous systems, climate modeling, and

personalized healthcare.

- Risks & Smart Investment Strategies in the AI Sector

Despite the enthusiasm, AI investing carries specific risks that

require disciplined strategies:

Risks to Watch:

Hype vs. Reality: Not all AI stocks with high valuations have

proven profitability or viable business models.

Regulatory Uncertainty: Ongoing global debates about AI

safety, data privacy, and copyright may impact growth.

Technological Obsolescence: AI is fast-evolving—today’s

leader could be outdated in 12 months.

Over-concentration: Many investors are heavily exposed to

a few names (e.g., NVIDIA), risking portfolio imbalance.

Conclusion: Betting on the Future, Not the Fad

AI is not just another tech trend—it’s the infrastructure of the

future economy. From the microchip to the algorithm to the

consumer-facing interface, AI is rebuilding the world again. Those

who understand this shift and invest with strategy, discipline, and

vision stand to benefit immensely.

Subscribe to Stoctok.com for weekly insights, market analysis,

and smart investment ideas as we explore the future—one

breakthrough at a time.

Your post is not just great; it\’s outstanding! It\’s evident that you put a lot of effort into creating this, and it shows. I look forward to your future posts.\”

Thank you for taking the time to share your thoughts. Your positive feedback is a reminder of why I love what I do.

I\’m so glad I stumbled upon this post. It\’s a breath of fresh air in the crowded world of WordPress content. Keep up the excellent work!

Thank you so much for your kind words! I\’m thrilled to hear that you enjoyed